Break in transmission: This blog has gone without updates for a few weeks due to illness and a family holiday. Things should now return to normal for the foreseeable future. In other news, today marks 3 years of this blog!

VIDEO: Hockey says poorest people ‘don’t drive very far’, ABC News (13 August 2014)

Suggestions that poor people either don’t own cars or drive their cars less by the Australian Treasurer Joe Hockey have resulted in Mr Hockey apologising for any hurt his comments have caused. The comments were made to ABC Radio on Wednesday, in which Mr Hockey said the following:

“The people that actually pay the most are higher income people, with an increase in fuel excise and yet the Labor Party and the Greens are opposing it. They say you’ve got to have wealthier people or middle-income people pay more.

Well, the change to the fuel excise does exactly that; the poorest people either don’t have cars or actually don’t drive very far in many cases. But we are actually, you know, they are opposing what is meant to be, according to the Treasury, a progressive tax.” – Joe Hockey, Australian Treasurer (13 August 2014)

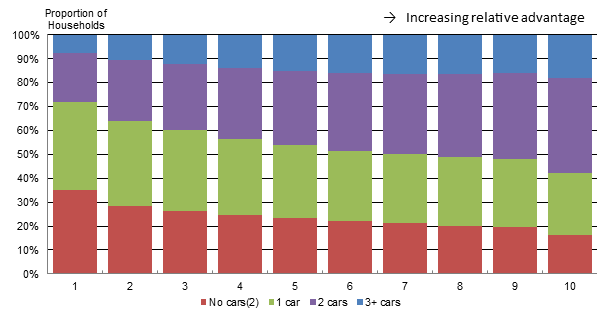

Later that day he backed up this statement with a clarifying statement, which stated that “average weekly expenditure on petrol in absolute terms increases with household income, from $16.36 at the lowest income quintile to $53.87 at the highest income quintile”. Meanwhile, it also showed that households with low socio-economic advantage were more likely to own no cars and least likely to own 3 or more cars. The opposite was the case for households with high socio-economic advantage.

Car ownership based on household socio-economic advantage. Click to enlarge. (Source: Australian Treasury based on ABS data.)

Critics were quick to take issue with Mr Hockey’s claims that this was a progressive tax. A progressive tax is defined as a tax that increases as a proportion of income as income rises. So to be progressive, an individual must not only pay more in tax as their income rises, but more tax as a proportion of their income. On this basis, although the richest quintile spent 3 times as much as the poorest on petrol ($53.87 vs $16.36), they also earned 11 times as much as the poorest ($3,942 vs $360) according to a report by the left leaning Australia Institute. The result is that the highest income quintile spent only 1.37% of their income on petrol, compared to 4.54% for the lowest income quintile. An increase in the price of petrol per litre would, according to this, disproportionately hit lower income households harder than higher income households.

https://twitter.com/NickEvershed/status/499742074946588672

The Shadow Transport Minister Anthony Albanese also criticised the increase in the fuel excise due to the government’s decision to cut all funding to urban commuter rail and other public transport. Doing so prevents individuals from being able to switch from the soon to be more expensive driving option to taking public transport, according to Mr Albanese.

RMIT Professor Jago Dodson analysed Mr Hockey’s statement as part of a fact check for The Conversation and found that it ranged from conditionally true to not necessarily true as well as partly unverifiable. Professor Dodson concluded that there was insufficient data available to fully verify that “poorer people either don’t own cars or don’t drive very far”, while finding the statement “higher-income people pay the most fuel excise” to be true on the basis of absolute spending on petrol. However, this did not hold up when considered as a proportion of income, which is the basis of determining whether a tax is progressive or not – another one of Mr Hockey’s claims.

In addition, Professor Dodson also stated a preference for using disposable income as the measure of income, rather than pre-tax/pre-welfare gross income figures that the Australia Institute report used. When looking at spending on petrol as a percentage of disposable income, it is the middle 60% of income earners who spend the most on petrol followed by low income earners and finally high income earners. The lowest income quintile spend less on petrol than all but the highest income quintile.

https://twitter.com/GrogsGamut/status/499444434589609984

All this shows that the answer to Mr Hockey’s rhetorical question is actually a much more complicated answer than the headlines may suggest.

Commentary: Why the fuel excise should be indexed

Lost in the whole discussion over whether and how much poor people drive cars is the question of whether re-indexing the fuel excise is good policy. The answer is yes. The reasons are listed in detail by Alan Davies at Crikey.

In brief, this policy will raise an additional $2.2bn over the next 4 years via the elimination of a tax cut rather than a tax increase. Indexation merely prevents the erosion of the tax base as prices increase. It will also make public transport more competitive while acting as a price on carbon (which did not exist under the carbon tax as petrol was exempted).

When determining how taxes are raised, it is better to tax the things that we as a society want to discourage. That is why alcohol and tobacco are taxed, that is why there was a push to put a price on carbon, and that is why the fuel excise is a good tax. If we choose to shift the tax base away from these areas, then it means taxing things that we as a society want to encourage, like income taxes on salaries. Alternatively it means cutting back on government spending. Neither of these is preferable to taxing something like petrol, and it is therefore disappointing to see this being ruled out as a revenue source.

The Australian Treasurer Joe Hockey. Click to enlarge. (Source: www.joehockey.com)

Where the government has made things difficult for itself is in ruling out funding public transport, urban commuter rail in particular. By doing so, it opens itself up to criticisms that it can’t use the price signal to encourage a shift from driving to public transport while simultaneously raising barriers to public transport by cutting funding. It would also make its life easier if it attempted to compensate the lower income earners from the impacts of re-indexation. This could be done at a low cost according to Mr Davies: “the poorest 20% of households could be compensated for indexation if just 8% of the additional revenue raised was returned to them through the tax-transfer system”.

The less you drive, the richer you are!

> Lost in the whole discussion over whether and how much poor people drive cars is the question of

> whether re-indexing the fuel excise is good policy. The answer is yes.

+1 for this though. As a non-driver perhaps I’m bias, but clearly this is (albeit minor) one of the structural problems with Federal gvt budget that should be addresses.

Congrats on the 3rd anniversary of the Blog

I can’t help thinking that it is all a cynical double bluff. Hockey now has the greens and labor voting against an increase in petrol tax. Just what he would have wanted!

…but the obvious problem with this theory is that I don’t think he’s that smart.

(and welcome back Bambul – much missed over the past weeks – so much happeniong and nowhere to rant)

I definitely agree that policy itself is a no brainer (and I hate that the Greens are opposing it out of pure politics before principle) but this is an incredibly poorly executed attempt to sell it. Surely any adviser with basic competence could have seen the end game of this straight away. I wonder who the genius in Hockey’s office that came up with this gem of a talking point in the first place was?

Surely we all understand what is meant by a regressive tax? To be so forgiving of a federal treasurer for calling it a progressive tax is difficult to understand I feel sorry for Mr Hockey if his statement is as an indicator of his knowledge of economics he would fail a simple year 11 NSW preliminary hsc topic test on taxation. A sad day for all Australians that the minister responsible for the Economy could be this ignorant. So please get up to speed and stop protecting the idiot with the b###s### commentary. HE NEEDS TO RESIGN

By the way could someone explain why the number of cars owned is a significant statistic in the discussion. Much to my disappointment I seem capable of driving only one car at a time. Are there RICH people who can drive more than one car at a time or again is this a little more complex than the mainstream media would like us to know? Or is it a simple equation more cars owned = more fuel consumed per capita??? Getting more like the cake, the GST and Dr Hewson.

My goodness what a wonderful growth tax that has been no losers in this ???? 10% of my $200 dollars of spending 10 years ago as opposed to 10% of my $300 as prices increase 10% of a greater number would need to be equal to a greater number so why is it not raising sufficient revenue? Perhaps the rate of growth in government spending has grown at a greater rate than CPI so are we getting value for money or are the custodians of our tax dollars not getting the value for money that they need to be getting for us.

It does not appear that we are in terms of public transport infrastructure, hard to believe that we are a first world country but we do not have a single fast train service in the country. Forget inter urban for the moment but surely intra urban should be an immediate and urgent priority. It currently takes between 50 minutes and an hour or more for some lines to travel 50 kilometres in any direction to and from Sydney City that would be an average speed of 50-60 kilometres per hour.

This should not be acceptable what happened to Barry O’s promise of a 20 minute trip from Penrith to the city? Let’s face it at an average speed of 240 kilometres per hour that trip is more than possible with the lower end of available fast trains. So let’s build the tracks that can take the trains and watch as congestion eases and the quality of life for young families in the outer suburbs improves and our cities become more live able in the current context. We need modern networks for the current lifestyles not a system that was great sixty years ago.

> By the way could someone explain why the number of cars owned is a significant statistic in the

> discussion. Much to my disappointment I seem capable of driving only one car at a time. Are there

> RICH people who can drive more than one car at a time or again is this a little more complex than

> the mainstream media would like us to know? Or is it a simple equation more cars owned = more

> fuel consumed per capita???

Because people who are truly rich actually don’t drive all that much themselves. They get other people to do it for them.

CC, number of cars per household is a significant statistic. Did you think it was number of cars per capita?

When did BoF promise a 20 minute trip to Penrith? He must have been smoking something pretty strong if he did.

For June quarter 2001 the CPI figure was 74.5. and for June quarter 2014 it is 105.9. On this basis, had not Mr Howard frozen the excise at 37.8 cents per litre, the excise would now be 53.7 cents per litre. This is a difference of 15.9 cents per litre.

Mr Hockey should have gone the whole hog and raised the excise by 15 or 16 cents per litre, and devoted at least half to urban public passenger transport. This 16 cents per litre is not too differrent from the variation in petrol price at my local garage in the weeks since the Budget, from 142.7 to 163.9. Now (yesterday) 154.9.

For CPI see:

https://www.ato.gov.au/rates/consumer-price-index/

Poor people do drive less. I am sure there are a lot of fairly poor bogans on the suburban fringe who have to have six cars so all their kids can get to work. But they are not the only poor people. What about all the people in nursing homes ? What about poor people living in the country ? There are a lot more poor people about than you might think. You can see lots of them on trains and buses.

What I found most curious about this particular storm in a teacup, was the dodgyness of the statistics. The ABC “fact checker” people found that Joe Hockey had relied on some ABS transport survey which among other things reported the number of cars per household. There was a huge proportion of responses to this survey, which reported “not stated” and “inapplicable” to the question, how many cars in your household.

The Treasury blundered by assuming that all the “not stated” and “inapplicable” responses, meant zero cars in the household, in all cases, and then came up with a quite obviously overstated percentage of households without cars.

Did no one even both to ask, why are there such a huge proportion of survey responses which are “not stated” or “inapplicable”. And what does “inapplicable” even mean, as a response to the survey distinct from the surveyed person not answering the question ? That’s the first question I would be asking, and we are all still none the wiser.

It is plausible that the large number of responses of “Not Stated” or “inapplicable” is due to a badly worded question, or bad instructions to the questioner. I assume that the interviews were done by telephone, in which case there would have been little indication of the type of household. ‘Inapplicable’ would be the response from a person who decides on the information given to him that he is not living in a household. Think nursing home, and even possibly sons or daughters living at home – they could be considered as not ‘head of household’ and so answer ‘not applicable’. That is stretching a point, I know, but until you see the actual question and instructions one must wonder.

Now, note again that all comments are in regard to “poor” people, but look at the transcript of what Joe Hockey said – “poorest people”. In effect these are the persons who are aged, living in nursing homes, living in a flat, or even living at home, who do not own a car, do not drive (not allowed a licence or feel too infirm to drive, etc). They are picked up by friends or neighbours to take them to the shops or whatever.

Concerned Citizen (Aug 15) gets it wrong. The Australia Institute may define a ‘regressive tax’ one way, Treasury may define it another – I would rather put my money on Treasury as being right. But in any case, look at the third graph, with the blue columns. It shows that the lowest quintile of the population spends LESS on petrol IN PROPORTION to their total annual expenditure than any other quintile except the very top quintile. So not only is the absolute amount very low, but the relative amount is less than the amount 60% of the population spends. Even by the Australia Institute’s definition, that means it is a progressive tax as far as the bottom 80% of the population is concerned.

Note also that Mr Hockey said “pay the most”. This means he was talking in ‘absolute terms’. The richest people would indeed pay the most with an increase, whether it be the 1 cent in the Budget, or the 15 cents per litre it should have been.

I can answer Concerned Citizen’s implied question (16th) – the rate of government expenditure has grown far faster than the CPI – Wayne Swan said he wanted to limit the increse in government spending to no more than 2% greater each year in real (ie, taking the fall in the value of money as CPI increases) terms, but neven managed to get it down to that level. And other Treasurers haven’t been much better, Mr Hockey will still have an increase in Government spending greater than CPI – somthing like 9% over the next four years, I think. And we are definitely not getting value for mmoney!

While I think of it, single people in rented accommodation would likely not think of themselves as being in a “household”, or it is plausible that the questioners were instructed to note NA in respect of such people.